Update - 6:28 p.m. ET, 1/26/21: Closing over $145 after another record day, Bloomberg analyst Eric Balchunas reports that GameStop was the most traded equity in the world today. It’s even continued to rise in after hours trading, bobbling over $200. DeepFuckingValue, the Redditor instrumental to starting this whole thing, reported he’s now up $22 million on his original investment in GameStop. Even billionaire asshole and part time James Bond villain Elon Musk tweeted about GameStop today.

Some on the WallStreetBets subreddit are now frantically asking one another what the exit plan is. Others are holding fast, intent on using this moment to stick it to big hedge funds. “We can think and make decisions for ourselves, which scares the FUCK out of old school institutions and hedge funds,” wrote one person on the subreddit. “Fuck them all. This affects every single one of you, whether or not you’re holding $GME. TLDR: Fuck hedge funds. This is a crosspoint into the future.”

Original story follows.

Last Friday, GameStop’s stock price closed at an all time high of $65. Today, it shot up 18% higher, breaking records again after an even wilder day of Wall Street roulette thanks to finance redditors and enthusiast day-traders who have turned things into a meme war against elite investors.

Just before lunch today, GameStop’s stock price peaked at $159, more than double its previous high back in the late 2000s, before the dramatic rise in digital game sales had called into question GameStop’s very existence. Just after lunch, it plummeted back down to $60, before another series of smaller booms and busts saw it finally close out the day at just under $77. The entire thing made Friday’s financial rollercoaster ride look tame by comparison.

Nothing about GameStop itself—the chain of over 5,000 small shops that are now just as likely to try to sell you a Doctor Who Funko Pop! as an actual video game—changed at all today. Instead, the price fluctuations were a continuation of the war being waged by WallStreetBets Reddit types against deep-pocketed investors who have been shorting GameStop stock and betting on its slow but inevitable demise. As Bloomberg reported today, “GameStop, which isn’t expected to turn a profit before 2023, has seen its market value triple to $4.5 billion in three weeks, burning the skeptics whose any attempt to cover is likely to further propel its ascent.” The question now is how long the shell game will continue. Analysts seem to agree the stock will inevitably collapse again sooner or later.

GameStop’s stock price saw an unprecedented spike around mid-morning.

Screenshot: Google

Part of what’s going on with GameStop is a test to see whether the financial alchemy that makes one company succeed where another fails can be manipulated by sheer determination. “The traditional Wall Street view is that markets are driven by some tie to fundamental value,” Corey Hoffstein, chief investment officer of investor research firm Newfound Research, told Wired on Friday. “What we’re seeing is an influx of speculative retail traders who don’t have any philosophy about valuation.”

With enough small traders rallied to its cause, WallStreetBets can create its own stock market reality, at least for a little while, specifically in cases like GameStop’s where other investors have thrown massive amounts of money behind the opposite bets. “It was a meme stock that really blew up,” WallStreetBets moderator Bawse1 told Wired. “The massive short contributed more toward the meme stock.”

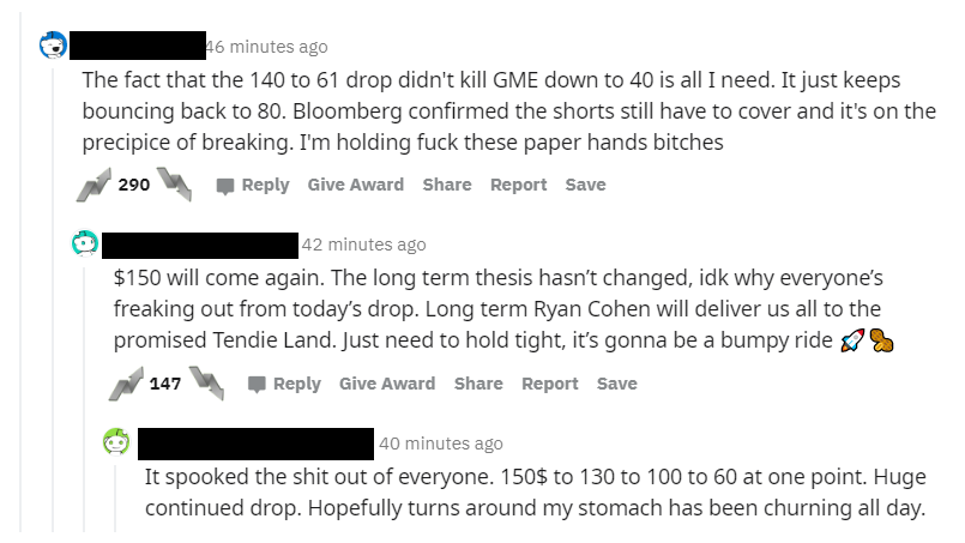

Some WallStreetBets commenters were shook after today’s market volatility.

Screenshot: Reddit (Fair Use)

One of those investors shorting the stock, Andrew Left of Citron Research, has gone silent for the time being, his last tweet blasting GameStop’s stock as wildly overvalued having gone up last Thursday. Melvin Capital Management is another; according to the Wall Street Journal, the investment firm oversaw $12.5 billion in funds in the beginning of the year. Three weeks later it’s already down 30%, due in part to “a series of wrong-way bets that stocks including GameStop Corp. would slump.” The firm is now in the process of getting an infusion of $2.75 billion more to help it cover the losses. Even many GameStop boosters were likely hit in today’s chaos.

“The odds are if you bought [GameStop shares] today, you’re down,” Steve Sosnick, chief strategist at Interactive Brokers, told Barron’s today. “The average share that was bought today is down by about 30%. These are incredibly treacherous situations to trade in. And that’s why my comment to the readers would be if they’re reading about this now, watch it with amusement. But now is not the time to jump into this game.”

While analysts say the stock hype can’t last, it’s already exposed, once again, just how much of a messed-up casino the stock market can be.

Update - 2:41 p.m. ET, 1/26/21: GameStop stock is back on its shit for a third day in a row. More frantic trading around mid-day sent it north of $120, and it appears some investors formerly on the side-lines are now joining the scramble.

Lots of $GME talk soooooo....

— Chamath Palihapitiya (@chamath) January 26, 2021

We bought Feb $115 calls on $GME this morning.

Let’s gooooooo!!!!!!!! https://t.co/XhOKL1fgKN pic.twitter.com/rbcB3Igl15

Venture capitalist and former Facebook executive, Chamath Palihapitiya, bought in earlier today and announced it on Twitter, providing further evidence that this is an exercise in nihilism rather than 12-dimensional financial chess.

Source: kotaku